Artificial intelligence: is your reporting giving investors what they need?

As the impact of AI grows, it’s a topic that we’re seeing gain a high profile in annual reporting. Investors are expecting deeper insight into how businesses are both incorporating AI into their strategies and managing its risks.

But as you prepare your 2026 reports, is your content matching investor expectations for high quality information around how you use and manage AI?

In the 2025 crop of FTSE 100 reports alone, 92 reporters discussed AI (compared to only 80 last year).

Regulators too, are moving beyond just observing how AI is used in reporting, to actively providing guidance and developing frameworks for its use. The Financial Reporting Council (FRC) has issued its first guidance on AI in audit, clarifying expectations and principles for responsible AI use in auditing.

Integration into the reporting narrative

Reporters are moving on from cautious, general references about AI to more specific discussions of opportunities, risks, and ethical considerations.

This evolution reflects a broader trend of companies moving beyond simply acknowledging AI's existence, to actively integrating it into their company strategy and reporting. In 2025, 57 reporters in the FTSE 100 discussed AI’s potential to benefit business operations, such as an enhanced customer experience and increased productivity. We also saw 23 reporters explain how AI is already being integrated into company operations and strategy. Reporters such as Pearson and Sage particularly, stand-out for their high-quality disclosures around how AI supports strategic delivery and business innovation.

Growing Board expertise

Board focus on AI risks and opportunities is also increasing. 38 of the FTSE 100 now reference it as a Board skill in their reports. This reflects AI's transformative impact, investor expectations and the need for effective AI governance and risk management.

Strengthening your reporting on AI topics

To ensure your reporting in this area is robust, first integrate any AI-related opportunities or risks to your business into the reporting narrative. Be specific and include any important detail so it’s not just a passing reference. Consider if and how it should be integrated across the wider report – from leadership statements and business models to governance, ethics, and sustainability – using clear examples and case studies.

Making your reporting AI readable

Just as AI is now a crucial topic for reporters to include within their reports, it’s also important for reporters to consider how AI tools are is accessing the annual report content.

Reports are being consumed and analysed not only by humans but also by AI-powered tools used by most investors and analysts. To make a report AI readable requires changes in how companies create and build their annual report – code and data quality matters because that is what AI reads.

AI cannot read PDF data effectively. To deliver accurate reliable analysis, AI needs to be able to access digital reporting online, and this needs native digital design solutions.

To solve this, we use next generation digital design software, Reportl. This enables companies to create multi-format reporting, fully readable by AI, and enhanced with data tagging for greater accuracy. All formats are created from a single digital source - not from print design software.

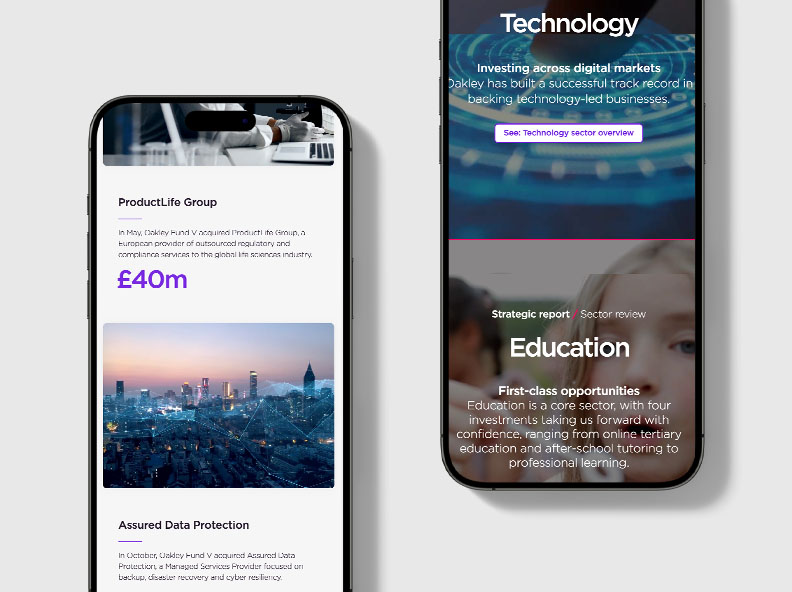

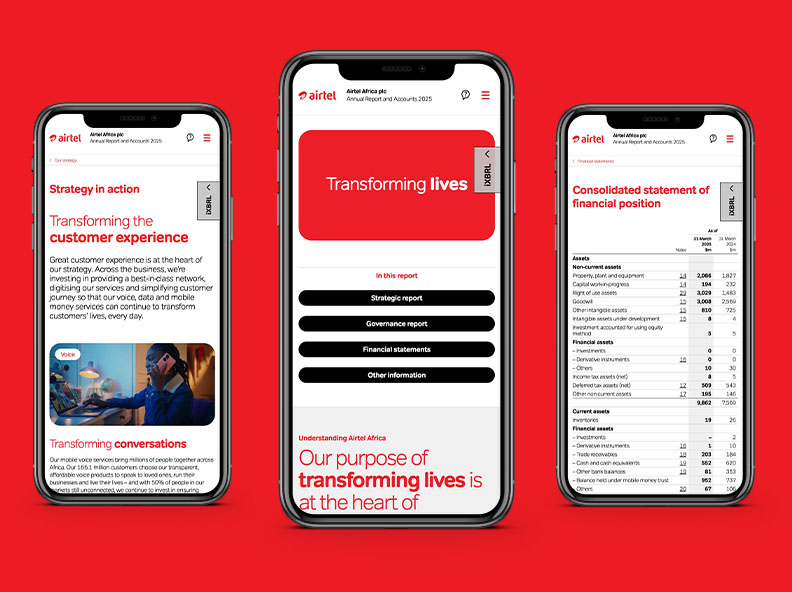

This approach is recommended by regulators, and recent examples of this include award-winning reports for FTSE 100 Airtel Africa and Oakley Capital Investments of the FTSE 250.

How reporters are preparing for changing sustainability requirements

Despite significant pushback from some against the ESG agenda and sustainability regulation in Europe and the USA, evidence shows that the integration of sustainability into UK annual reporting, on the whole, has not mirrored this changing sentiment.

As the 2026 reporting season ramps up, dig into our helpful insights about how emerging sustainability regulation is impacting the FTSE 100.

The impact of CSRD on UK reporting

The combined impact of CSRD and IFRS S1 and S2 constitutes a major shift for sustainability reporting, with some in the FTSE 100 already implementing CSRD regulation. In 2025, for the first time, six of the FTSE 100’s disclosures were compliant with CSRD, with these reports featuring significantly more comprehensive sustainability disclosures.

Of the six who reported in line, four - IAG, Relx, Shell and Unilever - chose to position their CSRD disclosures after the financial statements, a more communicative approach than the two reporters who chose to embed CSRD within their strategic reports. The additional disclosures bulked up these reports significantly, with some adding over 100 pages.

In addition to the six fully-compliant CSRD reporters, a further 45 of the FTSE 100 either referenced the plans they were making to prepare for compliance, or described their plans in more detail.

We will be keeping a close eye on how the CSRD Omnibus regulation impacts the next cycle of reports. The revised regulation will mean reporting delays for wave two and three companies, raised thresholds for compliance, and a reduced number of data points to report on.

Increasing references to ISSB, but little more than that

As IFRS S1 and S2 are not yet mandatory in the UK, FTSE 100 reporting on these Standards is less developed than CSRD. In 2025 42 of the FTSE 100 mentioned ISSB in their reports and most of these just made a simple passing reference.

Notably, two water companies - United Utilities and Severn Trent – have followed guidance from the ISSB and have used a TCFD-style four-pillar approach for sustainability disclosures beyond climate. Following the lead from these reporters, a logical next step for those wanting to begin alignment with the Standards, could be to begin reporting on risks and opportunities for each material issue.

Sustainability content length is stable, but expect this to rise

The length of the average annual report sustainability section last year was 21 pages, up slightly from 20 pages the year before. The impending arrival of UK Sustainability Reporting Standards (UK SRS) has not yet impacted the overall amount of sustainability content in the annual report, but we expect this to rise as the regulation comes into place, likely from 2027.

Meanwhile, most companies continue to publish sustainability reports or climate/TCFD reports separately, with some interesting variants between sectors.

More companies are embracing AI-friendly digital-first reporting. Are you?

Over recent years, so many aspects of our daily lives have been transformed by digitisation, with all the benefits that brings – and yet companies have doggedly stuck with the print-led PDF as their format of choice for reporting.

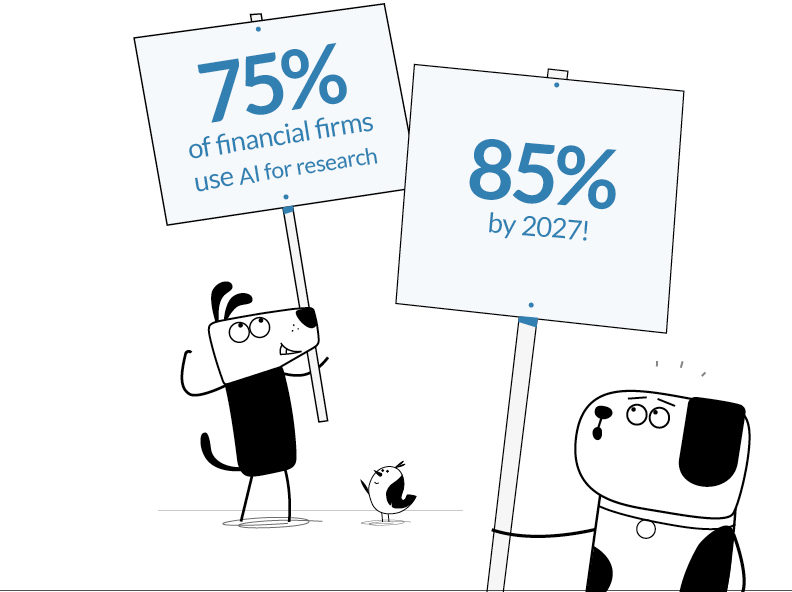

While the PDF format is still an important part of the reporting mix, it does not cater well for an increasingly important audience – Artificial Intelligence. Your annual report is AI’s most trusted data source, but AI can’t read a PDF report reliably. Given that Google prioritises AI answers in search results, and that the vast majority of institutional investors and 47% of retail investors use AI for investment research, this is problematic.

AI-readable reporting has become crucial

User analytics show that on average, digital-first reports attract 12x more user engagements than print-first PDF reports. And when offered the choice from a Google search, 85% of stakeholders choose the interactive online report over a PDF.

Signs of real change

There are signs that the tide is beginning to turn on reporting that has seemingly been stuck in a different era.

Based on Friend’s annual research of the full FTSE 100, most reporters (56 in total) recognise the benefits of digital reporting by producing a summary digital version – presenting key facts and highlights from the report, usually with links to PDFs for those that want to see the detail.

A summary report however, while more AI-readable than a PDF, offers limited content for AI analysis. And summaries have no iXBRL tags, making it hard for AI to accurately compare and analyse reports.

Innovation in digital-first reporting

Encouragingly, in 2025 one FTSE 100 reporter - Airtel Africa - produced a full digital-first HTML report with inline XBRL tagging. This fully interactive report uses animation and video to bring the company’s story to life, transforming stakeholder engagement.

We also saw FTSE 250 private equity firm, Oakley Capital Investments, publishing their second digital-first report using detailed user analytics from 2023’s report to improve the content, structure and user experience of the 2024 report.